Formation Of Companies And LLPs

What is an LLP?

Limited Liability Partnerships are normally called with their abbreviated form as LLP’s. It is a fusion structure between a partnership firm & a private limited company. In LLP’s business is carried out in a corporate framework as per the mutually accepted partnership deed. LLP’s are preferred when the partners are members of an institute or individual earnings are clearly defined, and distributed by dividend. Within an LLP the earnings of the members is normally seen as personal income.

Benefits of an LLP

The liability of partners is limited in case of an LLP whereas, partners are personally liable for debts of the business in a general partnership firm and even their personal property may be used to settle the firm’s debts. Under LLP structure, partners are not responsible for negligence or misconduct of other partners, so there is protection against wrong doings of other partners in LLPs.

Here are numerous benefits:

- Great flexibility in business management as the operation of the partnership and distribution of profits are determined with the written agreement between the members.

- One can operate the LLP with different levels of membership.

- In LLP a member, can rent, lease, or buy, own property he can employ person or team, enter into contracts, and be held accountable if necessary.

- LLP’s are a separate legal entity to the members and protect member’s personal assets from the liabilities of the business.

- He can prevent another partnership or company from registering the same name by registering the LLP.

Disadvantages of an LLP

In some cases, it may disadvantageous.

- Main disadvantage of LLPs is the Public disclosure. For the public record, the financial accounts have to be submitted and the accounts may affirm income of the members.

- No flexibility to hold over profit to a future tax year, all earned profit is proficiently distributed and profit can’t be fetch as it is in the company limited by shares.

- If one member chooses to leave the partnership, the LLP will be dissolved, as an LLP require at least two members.

How the Income Tax Act applied to LLPs?

Both general partnerships and LLPs are taxed at flat rate of 30% like partnership firms. All the other income tax act provisions are applied likewise except that general partnership firms are covered under presumptive taxation scheme.

What is the minimum capital requirement for LLPs?

There is no minimum capital requirement; LLPs can be registered even with Rs. 100 as total capital contribution.

Is there audit requirement for LLP?

If the turnover is Rs. 40 lakh or more or when the total capital contribution is Rs. 25 lakh or more, accounts of an LLP are needed to be audited.

Our LLP Formation Services Covers

- Government Fees (applicable upto Rs. 1 Lakh Capital Contribution by Designated Partners)

- Issue of Incorporation Certificate

- Drafting of LLP Deed

- Stamp Duty upto Rs. 2000/- and its Notarisation in any state in India for LLP Deed

- Designated Partner Identification Numbers - DPINs (2 nos.)

- Digital Signature Certificates - DSCs (2 nos.)

- Filing of E-forms

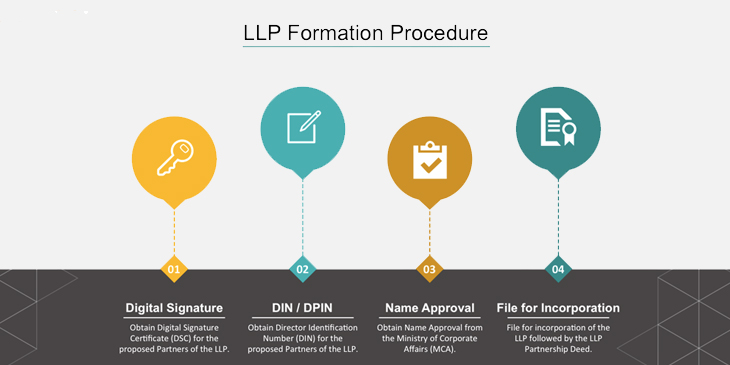

How It's Done

- DSC Application

- Reservation of Name

- Filing of LLP and DPIN application with Registrar

- Registration Certificate Receipt

- LLP Deed Notarisation

- Application for PAN and TAN

We support an individual or an entity in shaping out a Company or LLP as per the formation guidelines given under the act and making obligatory applications at suitable forum.